Despite the rapid development of the blockchain industry, myths about cryptocurrency continue to shape false perceptions about technologies, risks, and opportunities. They hinder a sober view of the market, confusing technological innovations with financial scams. To understand, it is worth not believing in loud headlines but carefully analyzing — where is the argument, and where is the empty stereotype.

Illusion of Anonymity: Why Blockchain Is Not a Mask but a Mirror

Among the most persistent myths about cryptocurrency is the belief in complete transaction anonymity. In practice, blockchain functions as a public ledger: every transfer remains in the chain forever.

For example, Ethereum retains metadata, including gas limits, cost, and sender’s address. Chainalysis and Elliptic regularly uncover cybercrimes precisely thanks to the open data of blockchains.

Claims of total anonymity have led to distrust from regulatory bodies, prompting the introduction of laws requiring mandatory KYC verification on exchanges. It is here that stereotypes and the reality of blockchain infrastructure come into direct contradiction.

Myth of Easy Money: Why Cryptocurrency Is Not a Golden Ticket

Doubts about the complexity of the market are fueled by sensational headlines: “Bitcoin Soars 80% in a Week.” Such spikes are often presented out of context. Behind them lies volatility caused by institutional purchases, regulatory rumors, or manipulations of volumes on illiquid exchanges. In 2022, the market capitalization of digital currencies dropped by $1.3 trillion — a figure comparable to Mexico’s GDP.

Stereotypes feeding the idea of instant wealth distract from the need for analysis. Each project requires studying the white paper, economic model, and consensus algorithms used — PoW, PoS, DPoS, each with its own risks and costs.

“Crypto Is a Pyramid Scheme”: Where the Line Is Drawn

Cryptocurrency is often associated with financial pyramids. The OneCoin story provided a reason for this stereotype: from 2014 to 2017, the team raised $4.4 billion without a real blockchain. However, any claims that mix open decentralized networks with pseudo tokens distort the picture.

Myths about crypto are fueled by ignorance in infrastructure matters. In reality, legal regulation implemented in the EU, Japan, and South Korea already filters out toxic schemes. The difference between an Ethereum-based project and a Ponzi scheme is like that between production and counterfeiting.

Bitcoin Is Outdated: Who Came Up with It and Why

The statement that Bitcoin is outdated has been heard since 2014. In reality, the first cryptocurrency continues to demonstrate high liquidity and infrastructural resilience. In 2023, Bitcoin processed transactions worth over $8 trillion, surpassing PayPal and nearly matching Visa in daily transfer volume.

Myths about cryptocurrency and Bitcoin obsolescence do not stand up to comparisons with facts: the Lightning Network allows almost instant micropayments, fees have dropped to $0.03 at peak times, and the Taproot upgrade enables the creation of private smart contracts.

Only for Techies? Technological ≠ Complex

Another persistent myth is that “cryptocurrency is too complex for beginners.” Interface development has simplified entry: mobile wallets like Trust Wallet offer asset storage and exchange in 3 clicks. Binance, Coinbase, OKX educate users through gamified projects with token rewards.

Applications automatically calculate fees, provide phishing protection, and use two-factor authentication, minimizing cybersecurity threats. Simplicity does not mean lack of analysis — each investment should be approached with an understanding of scalability, hashing, and consensus.

Many Prejudices: Decentralization and Control

Decentralization is often called a myth. Indeed, developers and node owners form the core of any project. But the claim that centralized players control the entire network distorts the essence. Participants in Ethereum Classic or Monero actively make decisions through voting using stake-based or hashrate-based consensus algorithms.

This stereotype loses its power in the face of practice: Cardano uses a PoS model with delegation, ensuring real decentralization through thousands of independent validators.

One Truth, Many Unspoken Words: Regulation, Laws, Scandals

Scandals in the industry are a reality. The FTX failure, the arrest of Sam Bankman-Fried, the account freezes at Celsius — these are facts, not exaggerations. However, generalizations harm understanding. Regulating the crypto market in the US, Singapore, and the EU has become an economic policy direction, not a fight against a threat.

Legislative acts like MiCA in Europe are already introducing mandatory reporting, changing the market and reducing risks. Myths about cryptocurrency and total chaos no longer correspond to the current infrastructure. Fees, security, and transparency are growing along with capitalization.

List of Shattered Misconceptions

Information distortions shape a false perception of digital assets, hindering understanding of their real value and purpose.

The most persistent myths about cryptocurrency:

- Complete anonymity — blockchain records everything, Chainalysis tracks flows in real time.

- Easy money — market volatility makes investments risky without analysis and understanding.

- Pyramid scheme — real projects are based on algorithms, code, and open-source.

- Outdated Bitcoin — Lightning Network and Taproot updated the protocol.

- Complexity for beginners — interfaces are intuitive, education is accessible.

- Lack of regulation — laws are already in place, markets are being legalized.

- Centralization — decentralization works through consensus and staking.

- Inapplicability — DeFi, NFTs, stablecoins already serve millions of users.

Each of these misconceptions stems from ignorance and lack of analysis. Dispelling myths allows one to perceive digital currency not as a passing trend but as part of a new financial reality.

Novice = Victim? Not Necessarily.

Cryptocurrency for beginners has ceased to be a minefield. Successful examples: Argent, Kraken, Revolut, MoonPay have integrated fiat money, simplifying exchanges, purchases, and withdrawals. Transaction analysis and automatic contract verification minimize risks.

Myths about cryptocurrency are dispelled by facts. Comparisons with gold, liquidity, and exchange dynamics show that digital assets have already taken a place alongside traditional instruments.

Fact Instead of Fiction: The Truth About Cryptocurrency Speaks Louder Than Myths

Exposed myths about cryptocurrency point to one thing: the industry has outgrown the status of an experiment. Examples like institutional investments from BlackRock, the creation of the EDX crypto exchange under the aegis of Citadel and Charles Schwab, stable growth of DeFi infrastructure confirm that digital assets have become part of the global financial system.

The crypto market requires discipline, technical understanding, and a sober assessment of risks. Project scalability, hashing algorithms, consensus mechanisms — these are not just words from whitepapers but pillars of the ecosystem. Mistakes arise not from technologies but from stereotypes that replace knowledge with conjecture.

Myths About Cryptocurrency: Conclusions

Myths about cryptocurrency distort the market perception, replacing facts with fears. In reality, crypto demonstrates growth, liquidity, and technological development. Erroneous judgments like “all projects are pyramids” lose their power against verifiable data and real infrastructure. Debunking misconceptions is a step towards a conscious approach where emotions are not important, but analysis and understanding of the essence.

In the pool model, the hashrates of thousands of participants are combined. This increases the chance of finding a block, but reduces the individual income. In a pool, the profit is divided among everyone in proportion to their contribution. Participation reduces risks, but reduces control. To understand the difference, it is necessary to compare the most important parameters.

In the pool model, the hashrates of thousands of participants are combined. This increases the chance of finding a block, but reduces the individual income. In a pool, the profit is divided among everyone in proportion to their contribution. Participation reduces risks, but reduces control. To understand the difference, it is necessary to compare the most important parameters.

The solo approach is more than a technical strategy. It is an ideological choice. In an era of centralized resources and the rise of mining pools, it is a statement of intent if you can do it alone. The model is not suitable for mass use, but it survives thanks to enthusiasts and professionals who know how to build infrastructure, estimate opportunities and work in the long term.

The solo approach is more than a technical strategy. It is an ideological choice. In an era of centralized resources and the rise of mining pools, it is a statement of intent if you can do it alone. The model is not suitable for mass use, but it survives thanks to enthusiasts and professionals who know how to build infrastructure, estimate opportunities and work in the long term.

The current rating of the platform is based on security, cost-effectiveness, interface, contract flexibility and support.

The current rating of the platform is based on security, cost-effectiveness, interface, contract flexibility and support.

The best cloud mining services of 2025 will go beyond just renting hashrate. They will become ecosystems: combining mining, trading, NFTs, storage, and analytics. Success will be determined not only by profitability, but also by transparency, support, control, and security.

The best cloud mining services of 2025 will go beyond just renting hashrate. They will become ecosystems: combining mining, trading, NFTs, storage, and analytics. Success will be determined not only by profitability, but also by transparency, support, control, and security.

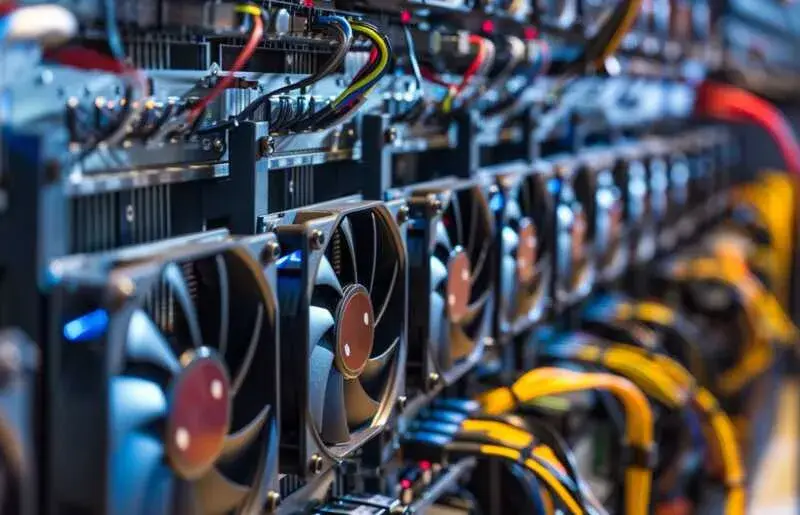

When considering the efficiency of cryptocurrency mining for beginners, it is important to note that the prospects directly depend on the choice of equipment and software. When the budget is limited, the GPU format is the most logical solution. Modern graphics cards from Nvidia and AMD are able to provide high performance at an affordable price, allowing you to mine at the level of several megahashes per second. With extra money, investors can consider ASIC miners such as the Bitmain AntMiner S19 Pro, which provides a hash rate of up to 184 TH/s. High-performance ASICs significantly increase the chance of finding a block, but these devices require a significant investment (tens of thousands of dollars) and entail high operational costs.

When considering the efficiency of cryptocurrency mining for beginners, it is important to note that the prospects directly depend on the choice of equipment and software. When the budget is limited, the GPU format is the most logical solution. Modern graphics cards from Nvidia and AMD are able to provide high performance at an affordable price, allowing you to mine at the level of several megahashes per second. With extra money, investors can consider ASIC miners such as the Bitmain AntMiner S19 Pro, which provides a hash rate of up to 184 TH/s. High-performance ASICs significantly increase the chance of finding a block, but these devices require a significant investment (tens of thousands of dollars) and entail high operational costs. A thorough analysis of cryptocurrency mining for beginners shows that success in this area depends on an approach that combines technical knowledge, economic analysis and strategic planning. Smart investments in equipment, the use of reliable software and participation in optimized pools ensure stable profitability and minimal risks.

A thorough analysis of cryptocurrency mining for beginners shows that success in this area depends on an approach that combines technical knowledge, economic analysis and strategic planning. Smart investments in equipment, the use of reliable software and participation in optimized pools ensure stable profitability and minimal risks.

The process consists of several stages, and in each stage, users perform important tasks to maintain the blockchain. This can be understood by studying each step in the operation of this system in detail.

The process consists of several stages, and in each stage, users perform important tasks to maintain the blockchain. This can be understood by studying each step in the operation of this system in detail. Why do we need blockchain mining? It is the mechanism that keeps the network running, ensures security and creates new currencies. It enables decentralized transaction verification and data protection against hacking. Without blockchain, the transparency and reliability of data cannot be guaranteed.

Why do we need blockchain mining? It is the mechanism that keeps the network running, ensures security and creates new currencies. It enables decentralized transaction verification and data protection against hacking. Without blockchain, the transparency and reliability of data cannot be guaranteed.

The systems solve several important problems:

The systems solve several important problems: A mining farm is an effective tool for mining cryptocurrencies and investing in digital assets. Understanding the system structure, costs, and cooling principles will help you approach the process competently. Successful operation requires careful selection of components and proper setup. Follow these guidelines to minimize risks and earn a steady income.

A mining farm is an effective tool for mining cryptocurrencies and investing in digital assets. Understanding the system structure, costs, and cooling principles will help you approach the process competently. Successful operation requires careful selection of components and proper setup. Follow these guidelines to minimize risks and earn a steady income.

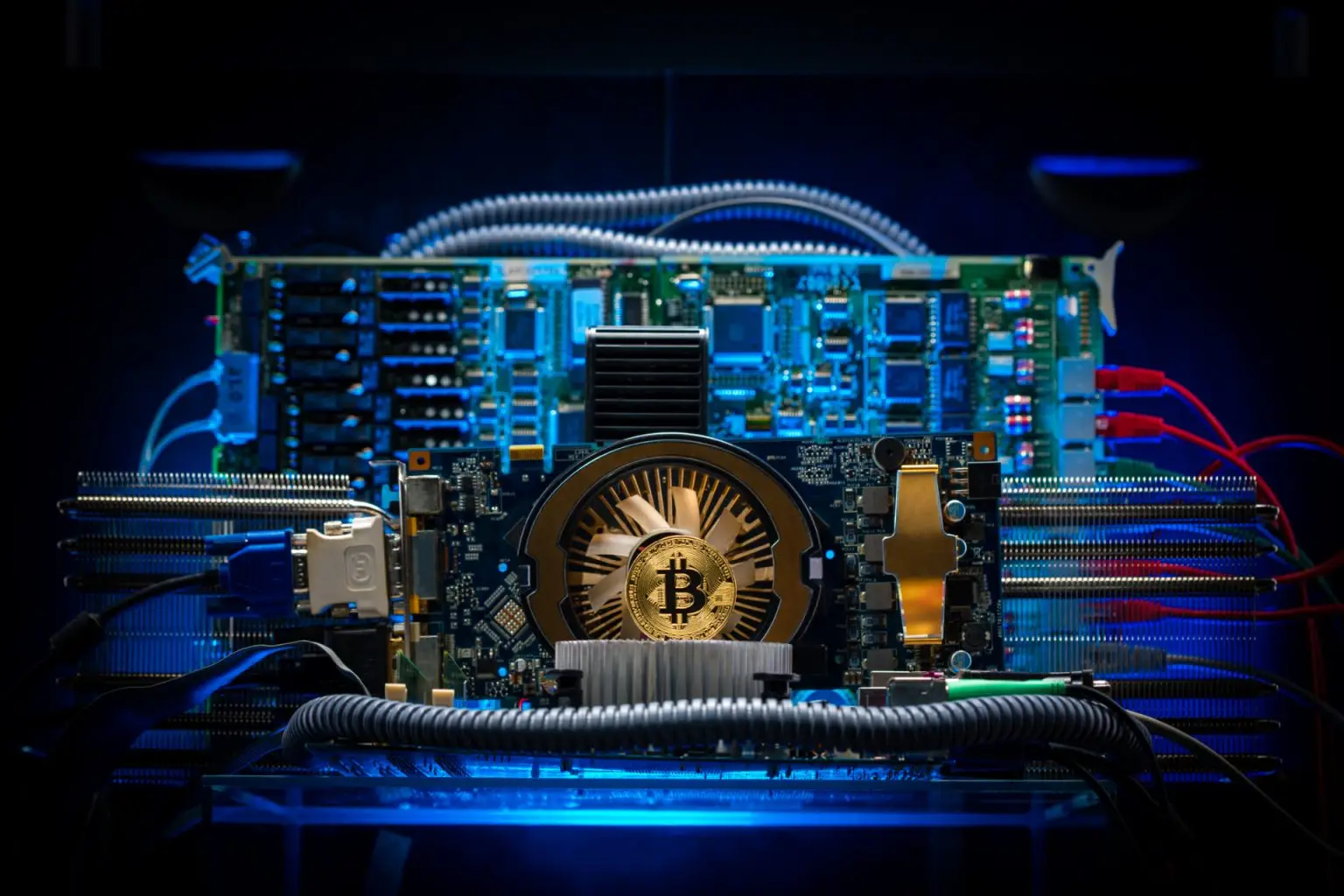

Mining equipment plays a crucial role in the efficiency and profitability of the process. There are different types of equipment, each with its own advantages and disadvantages.

Mining equipment plays a crucial role in the efficiency and profitability of the process. There are different types of equipment, each with its own advantages and disadvantages. How to mine cryptocurrency is an important question for anyone who wants to make a profit from digital assets. Knowing the basics of mining, choosing the right equipment, and effectively managing electricity costs are essential for successful cryptocurrency mining. By following the given recommendations and taking into account the legal aspects, you can significantly increase the profitability and security of your operations. Discover different mining methods, choose the best solutions, and start your cryptocurrency adventure with confidence and knowledge.

How to mine cryptocurrency is an important question for anyone who wants to make a profit from digital assets. Knowing the basics of mining, choosing the right equipment, and effectively managing electricity costs are essential for successful cryptocurrency mining. By following the given recommendations and taking into account the legal aspects, you can significantly increase the profitability and security of your operations. Discover different mining methods, choose the best solutions, and start your cryptocurrency adventure with confidence and knowledge.

Now let’s look at how profitable it is to mine Bitcoin in 2024. The complexity of mining has increased and the value of the coin is increasing, but it is also volatile.

Now let’s look at how profitable it is to mine Bitcoin in 2024. The complexity of mining has increased and the value of the coin is increasing, but it is also volatile. Bitcoin mining is not a quick and easy business, but with the right approach it can be profitable. In 2024, mining could still be profitable despite increasing process complexity and equipment costs. If you’re prepared to invest in the right equipment and strategy, you can start mining today.

Bitcoin mining is not a quick and easy business, but with the right approach it can be profitable. In 2024, mining could still be profitable despite increasing process complexity and equipment costs. If you’re prepared to invest in the right equipment and strategy, you can start mining today.

Every investment strategy involves risks. We cannot talk without mentioning the possible problems that users face.

Every investment strategy involves risks. We cannot talk without mentioning the possible problems that users face. The technology continues to evolve, providing Russians with an accessible and easy way to enter the world of cryptocurrencies. Given the economic changes and the growing interest in cryptocurrency investments, cloud mining could become an important strategy for those who want to earn a stable income in the future.

The technology continues to evolve, providing Russians with an accessible and easy way to enter the world of cryptocurrencies. Given the economic changes and the growing interest in cryptocurrency investments, cloud mining could become an important strategy for those who want to earn a stable income in the future.

The profitability of mining depends on many factors: the price of electricity, the performance of the equipment, the complexity of the network and current market rates. To fully understand what crypto-currency mining is and how to assess its profitability, you need to consider all the costs – the cost of electricity and equipment depreciation.

The profitability of mining depends on many factors: the price of electricity, the performance of the equipment, the complexity of the network and current market rates. To fully understand what crypto-currency mining is and how to assess its profitability, you need to consider all the costs – the cost of electricity and equipment depreciation. What is crypto-currency mining? It’s a complex but fascinating process that not only makes the blockchain system work, but also generates potential income. The choice between the different ways of obtaining crypto-currency depends on the resources available and the willingness to take risks. It is an activity that requires significant knowledge and effort, but for many it is becoming not only a source of income, but also a way of participating in the new financial era.

What is crypto-currency mining? It’s a complex but fascinating process that not only makes the blockchain system work, but also generates potential income. The choice between the different ways of obtaining crypto-currency depends on the resources available and the willingness to take risks. It is an activity that requires significant knowledge and effort, but for many it is becoming not only a source of income, but also a way of participating in the new financial era.