The cryptocurrency industry offers a wide range of ways to earn rewards. When the network is overloaded, the question becomes relevant as to what solo mining is and why more and more experts are choosing it instead of a pool. The model is a direct interaction with the blockchain, without intermediaries. This increases control, but also increases technical and financial burdens. The analysis starts with the main principles: node architecture and hash rate parameters.

How does solo mining work? What it is, the technical basis of the process

The essence of solo mining is that you independently find a block, without using the computing power of other participants. Unlike the pool model, where the entire hash rate is pooled, each participant calculates and solves problems locally. To understand what solo mining is and how it works, it is necessary to study the infrastructure and software dependencies.

Main elements:

- Full node: a local blockchain wallet on which the current version of the network runs.

- Mining software: CGMiner, BFGMiner, Phoenix or custom clients.

- Hashrate: the minimum allowed volume of calculations depends on the algorithm (for BTC, from 200 TH/s).

Network connection: high stability and channel performance.

The miner processes tasks independently, compares hashes and sends the found blocks to the network. The reward is sent directly to the local address. No external server or mining pool.

Differences with pool mining: When should you stop pool mining?

In the pool model, the hashrates of thousands of participants are combined. This increases the chance of finding a block, but reduces the individual income. In a pool, the profit is divided among everyone in proportion to their contribution. Participation reduces risks, but reduces control. To understand the difference, it is necessary to compare the most important parameters.

In the pool model, the hashrates of thousands of participants are combined. This increases the chance of finding a block, but reduces the individual income. In a pool, the profit is divided among everyone in proportion to their contribution. Participation reduces risks, but reduces control. To understand the difference, it is necessary to compare the most important parameters.

Fundamental differences:

- Pool: stable but average results.

- Solo: unstable but potentially large income.

- Pool: requires connection to a remote server.

- Solo: uses a local full node and is self-contained.

Mining without a pool is only relevant if you have a lot of capital or if you are mining unpopular coins, where the difficulty is lower and the competition is minimal.

Examples of coins and settings: where solo mining is still profitable

A solo approach does not lose its relevance in certain niches. For example, for projects with low complexity or that are in the start-up phase. It is useful to understand solo mining by specific use cases, such as platform parameters, profitability, and costs.

Popular scenarios:

- Bitcoin: profitability with a capacity of 300 TH/s (Antminer S19 Pro × 10 pieces), the probability of finding a block is 1 in 5000 per month.

- Ethereum Classic: platform on 6×RX 5700 XT, total hash rate: 360 MH/s, probability: 1 block in 90–120 days.

- Monero: CPU-oriented mining (Ryzen 9 5950X), block every 1.5-2 months.

Solo cryptocurrency mining here depends on two parameters: the level of competition on the network and the current difficulty level. The growing popularity of a project drastically reduces the profitability of an individual strategy.

Profitability and risk: mathematics and psychology of expectation

A solo miner receives the full block reward, including transaction fees and the base reward. For Bitcoin, this is 6.25 BTC, for Ethereum Classic, this is 2.5 ETC. At the current exchange rate, the price would be between $160,000 and $40,000. But the frequency of such victories is unpredictable. The model can only be evaluated using theoretical returns and long-term risks.

Influencing factors:

- A participant’s hash rate relative to the total network power.

- Complexity of blocks.

- Cost of electricity.

- The size of commissions on the network.

In practice, solo mining is a kind of lottery with a mathematical twist. The greater the strength of the team, the closer the probability is to reality. But without any guarantee within the set time frame. Some miners wait months or even years for a block before they get the result.

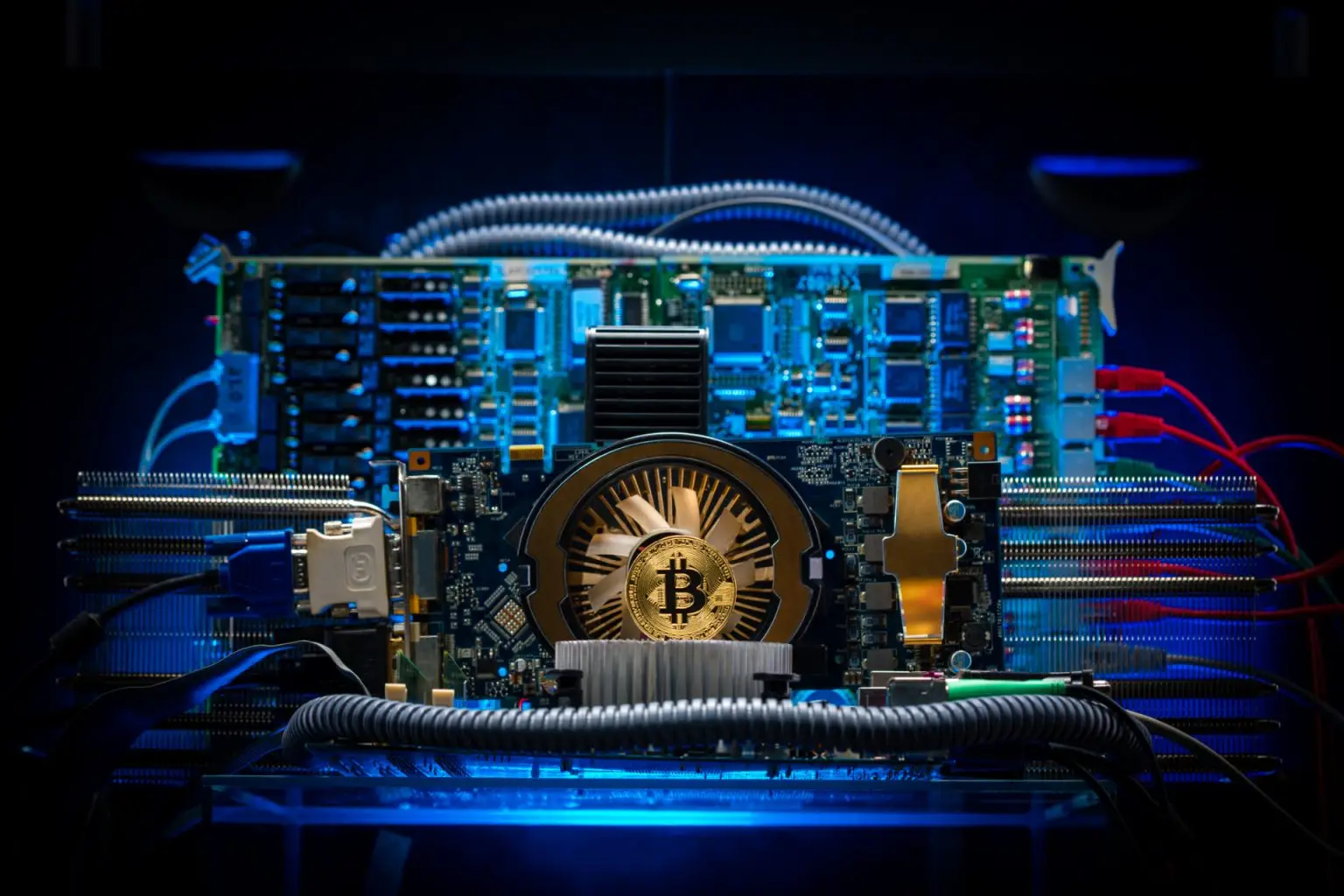

The Team’s Role: How to Build a Personal Mining Rig

The team determines efficiency. Without a powerful rig, the chances of finding a block are virtually zero. A solo mining strategy requires a well-thought-out setup optimized for a specific algorithm. There is no one-size-fits-all solution: every project has unique hardware and power requirements.

Main mounting options:

- SHA-256 (Bitcoin): ASIC devices – Antminer S19 Pro (110 TH/s), power consumption – 3250 W, price – from $2800 per unit.

- Echash (Ethereum Classic): GPU rigs: 6×RX 6700 XT, hash rate: ~360 MH/s, power consumption: 900–1100 W, cost: ~$5000.

- RandomX (Monero): CPU solutions: Ryzen 9 7950X, hash rate ~18 KH/s, power consumption: 140–160 W, price: ~$650.

The power determines the position in the hash distribution. The higher the total hashrate, the higher the chance. It is important to consider noise, ventilation, and the lifespan of the device to find a balance between the initial investment and the running costs.

Blockchain architecture: what is it and how does it impact solo mining?

Any mining activity is a mathematical profession. In solo mining, the user communicates directly with the blockchain network via a node. Working with a local client provides complete independence, but requires resources. Network architecture affects the complexity, type of algorithm, block time, and the ability to participate in consumer hardware.

Influencing parameters:

- A blockchain with a long block interval (for example, Bitcoin – 10 minutes) ensures that rewards are received less often.

- Thanks to algorithms such as RandomX (CPU-oriented), you can participate even without a video card.

- The high network hash rate of popular projects (BTC, ETHW) makes individual participation unlikely.

- An increase in transaction fees can increase the profitability of a block many times over.

When choosing a coin to mine without a pool, it is important to consider not only the complexity, but also the economics of the network, the speed of block generation, the variability of the algorithm and the possibility of a future hard fork.

Commission and the impact of transaction fees on the final profit

A solo miner’s income consists of two components: a fixed reward for a block and a variable component: a fee for the included transactions. During the active period of the network, the collection rate is 30-40% of the total amount. This is especially true for Ethereum-like projects and networks with high load. A lot of network activity (NFTs, DeFi, tokenization) generates high fees, so even finding a rare block can be extremely profitable. In contrast, during periods with low transaction load, the miner only receives a basic level, which reduces motivation.

Pros and cons: when solo mining is worth it

Solo strategy is not for everyone. It requires cold-blooded calculations, willingness to work for a long time without results, technical knowledge and above-average equipment. In order to assess the feasibility of an approach, a summary of the parameters is necessary.

Advantages:

- Full control over the process.

- No external dependency on the pool.

- The total income is received without distribution.

- Independence from profit-sharing schemes.

Disadvantages:

- High entry costs.

- Instability of results.

- A long period without reward.

- Higher installation and maintenance requirements.

The effectiveness of the model depends on the level of investment, the understanding of the algorithm and the willingness to work autonomously. Solo mining remains a form of ‘chess’ on the blockchain, where each move costs electricity and the outcome depends on the calculation.

What is solo mining? Choosing autonomy or challenging the system?

The solo approach is more than a technical strategy. It is an ideological choice. In an era of centralized resources and the rise of mining pools, it is a statement of intent if you can do it alone. The model is not suitable for mass use, but it survives thanks to enthusiasts and professionals who know how to build infrastructure, estimate opportunities and work in the long term.

The solo approach is more than a technical strategy. It is an ideological choice. In an era of centralized resources and the rise of mining pools, it is a statement of intent if you can do it alone. The model is not suitable for mass use, but it survives thanks to enthusiasts and professionals who know how to build infrastructure, estimate opportunities and work in the long term.

What is solo mining? It is a job at the intersection: between mathematics and luck, between infrastructure and discipline. It is not about making easy money, but about a systematic challenge. With the right preparation and a serious hashrate, it can become a source of great profits. Without experience, you will end up in a series of failures.

The current rating of the platform is based on security, cost-effectiveness, interface, contract flexibility and support.

The current rating of the platform is based on security, cost-effectiveness, interface, contract flexibility and support. The best cloud mining services of 2025 will go beyond just renting hashrate. They will become ecosystems: combining mining, trading, NFTs, storage, and analytics. Success will be determined not only by profitability, but also by transparency, support, control, and security.

The best cloud mining services of 2025 will go beyond just renting hashrate. They will become ecosystems: combining mining, trading, NFTs, storage, and analytics. Success will be determined not only by profitability, but also by transparency, support, control, and security.

When considering the efficiency of cryptocurrency mining for beginners, it is important to note that the prospects directly depend on the choice of equipment and software. When the budget is limited, the GPU format is the most logical solution. Modern graphics cards from Nvidia and AMD are able to provide high performance at an affordable price, allowing you to mine at the level of several megahashes per second. With extra money, investors can consider ASIC miners such as the Bitmain AntMiner S19 Pro, which provides a hash rate of up to 184 TH/s. High-performance ASICs significantly increase the chance of finding a block, but these devices require a significant investment (tens of thousands of dollars) and entail high operational costs.

When considering the efficiency of cryptocurrency mining for beginners, it is important to note that the prospects directly depend on the choice of equipment and software. When the budget is limited, the GPU format is the most logical solution. Modern graphics cards from Nvidia and AMD are able to provide high performance at an affordable price, allowing you to mine at the level of several megahashes per second. With extra money, investors can consider ASIC miners such as the Bitmain AntMiner S19 Pro, which provides a hash rate of up to 184 TH/s. High-performance ASICs significantly increase the chance of finding a block, but these devices require a significant investment (tens of thousands of dollars) and entail high operational costs. A thorough analysis of cryptocurrency mining for beginners shows that success in this area depends on an approach that combines technical knowledge, economic analysis and strategic planning. Smart investments in equipment, the use of reliable software and participation in optimized pools ensure stable profitability and minimal risks.

A thorough analysis of cryptocurrency mining for beginners shows that success in this area depends on an approach that combines technical knowledge, economic analysis and strategic planning. Smart investments in equipment, the use of reliable software and participation in optimized pools ensure stable profitability and minimal risks.

The process consists of several stages, and in each stage, users perform important tasks to maintain the blockchain. This can be understood by studying each step in the operation of this system in detail.

The process consists of several stages, and in each stage, users perform important tasks to maintain the blockchain. This can be understood by studying each step in the operation of this system in detail. Why do we need blockchain mining? It is the mechanism that keeps the network running, ensures security and creates new currencies. It enables decentralized transaction verification and data protection against hacking. Without blockchain, the transparency and reliability of data cannot be guaranteed.

Why do we need blockchain mining? It is the mechanism that keeps the network running, ensures security and creates new currencies. It enables decentralized transaction verification and data protection against hacking. Without blockchain, the transparency and reliability of data cannot be guaranteed.

The systems solve several important problems:

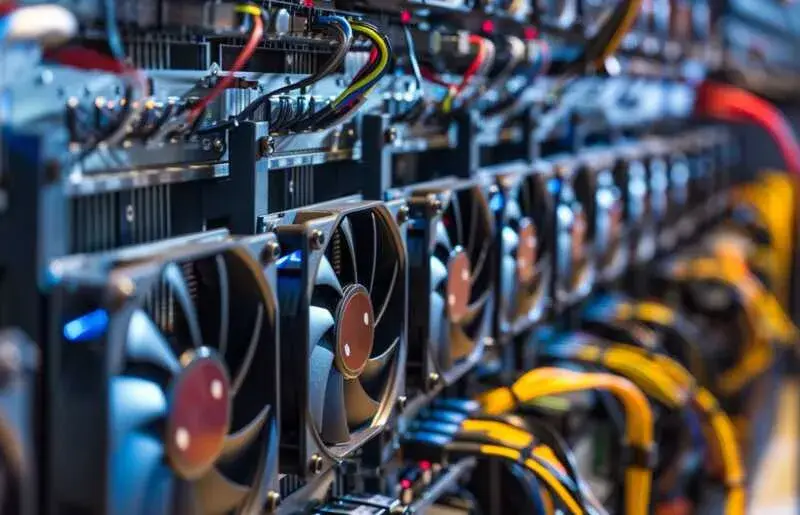

The systems solve several important problems: A mining farm is an effective tool for mining cryptocurrencies and investing in digital assets. Understanding the system structure, costs, and cooling principles will help you approach the process competently. Successful operation requires careful selection of components and proper setup. Follow these guidelines to minimize risks and earn a steady income.

A mining farm is an effective tool for mining cryptocurrencies and investing in digital assets. Understanding the system structure, costs, and cooling principles will help you approach the process competently. Successful operation requires careful selection of components and proper setup. Follow these guidelines to minimize risks and earn a steady income.

Mining equipment plays a crucial role in the efficiency and profitability of the process. There are different types of equipment, each with its own advantages and disadvantages.

Mining equipment plays a crucial role in the efficiency and profitability of the process. There are different types of equipment, each with its own advantages and disadvantages. How to mine cryptocurrency is an important question for anyone who wants to make a profit from digital assets. Knowing the basics of mining, choosing the right equipment, and effectively managing electricity costs are essential for successful cryptocurrency mining. By following the given recommendations and taking into account the legal aspects, you can significantly increase the profitability and security of your operations. Discover different mining methods, choose the best solutions, and start your cryptocurrency adventure with confidence and knowledge.

How to mine cryptocurrency is an important question for anyone who wants to make a profit from digital assets. Knowing the basics of mining, choosing the right equipment, and effectively managing electricity costs are essential for successful cryptocurrency mining. By following the given recommendations and taking into account the legal aspects, you can significantly increase the profitability and security of your operations. Discover different mining methods, choose the best solutions, and start your cryptocurrency adventure with confidence and knowledge.

Now let’s look at how profitable it is to mine Bitcoin in 2024. The complexity of mining has increased and the value of the coin is increasing, but it is also volatile.

Now let’s look at how profitable it is to mine Bitcoin in 2024. The complexity of mining has increased and the value of the coin is increasing, but it is also volatile. Bitcoin mining is not a quick and easy business, but with the right approach it can be profitable. In 2024, mining could still be profitable despite increasing process complexity and equipment costs. If you’re prepared to invest in the right equipment and strategy, you can start mining today.

Bitcoin mining is not a quick and easy business, but with the right approach it can be profitable. In 2024, mining could still be profitable despite increasing process complexity and equipment costs. If you’re prepared to invest in the right equipment and strategy, you can start mining today.

Every investment strategy involves risks. We cannot talk without mentioning the possible problems that users face.

Every investment strategy involves risks. We cannot talk without mentioning the possible problems that users face. The technology continues to evolve, providing Russians with an accessible and easy way to enter the world of cryptocurrencies. Given the economic changes and the growing interest in cryptocurrency investments, cloud mining could become an important strategy for those who want to earn a stable income in the future.

The technology continues to evolve, providing Russians with an accessible and easy way to enter the world of cryptocurrencies. Given the economic changes and the growing interest in cryptocurrency investments, cloud mining could become an important strategy for those who want to earn a stable income in the future.

The profitability of mining depends on many factors: the price of electricity, the performance of the equipment, the complexity of the network and current market rates. To fully understand what crypto-currency mining is and how to assess its profitability, you need to consider all the costs – the cost of electricity and equipment depreciation.

The profitability of mining depends on many factors: the price of electricity, the performance of the equipment, the complexity of the network and current market rates. To fully understand what crypto-currency mining is and how to assess its profitability, you need to consider all the costs – the cost of electricity and equipment depreciation. What is crypto-currency mining? It’s a complex but fascinating process that not only makes the blockchain system work, but also generates potential income. The choice between the different ways of obtaining crypto-currency depends on the resources available and the willingness to take risks. It is an activity that requires significant knowledge and effort, but for many it is becoming not only a source of income, but also a way of participating in the new financial era.

What is crypto-currency mining? It’s a complex but fascinating process that not only makes the blockchain system work, but also generates potential income. The choice between the different ways of obtaining crypto-currency depends on the resources available and the willingness to take risks. It is an activity that requires significant knowledge and effort, but for many it is becoming not only a source of income, but also a way of participating in the new financial era.