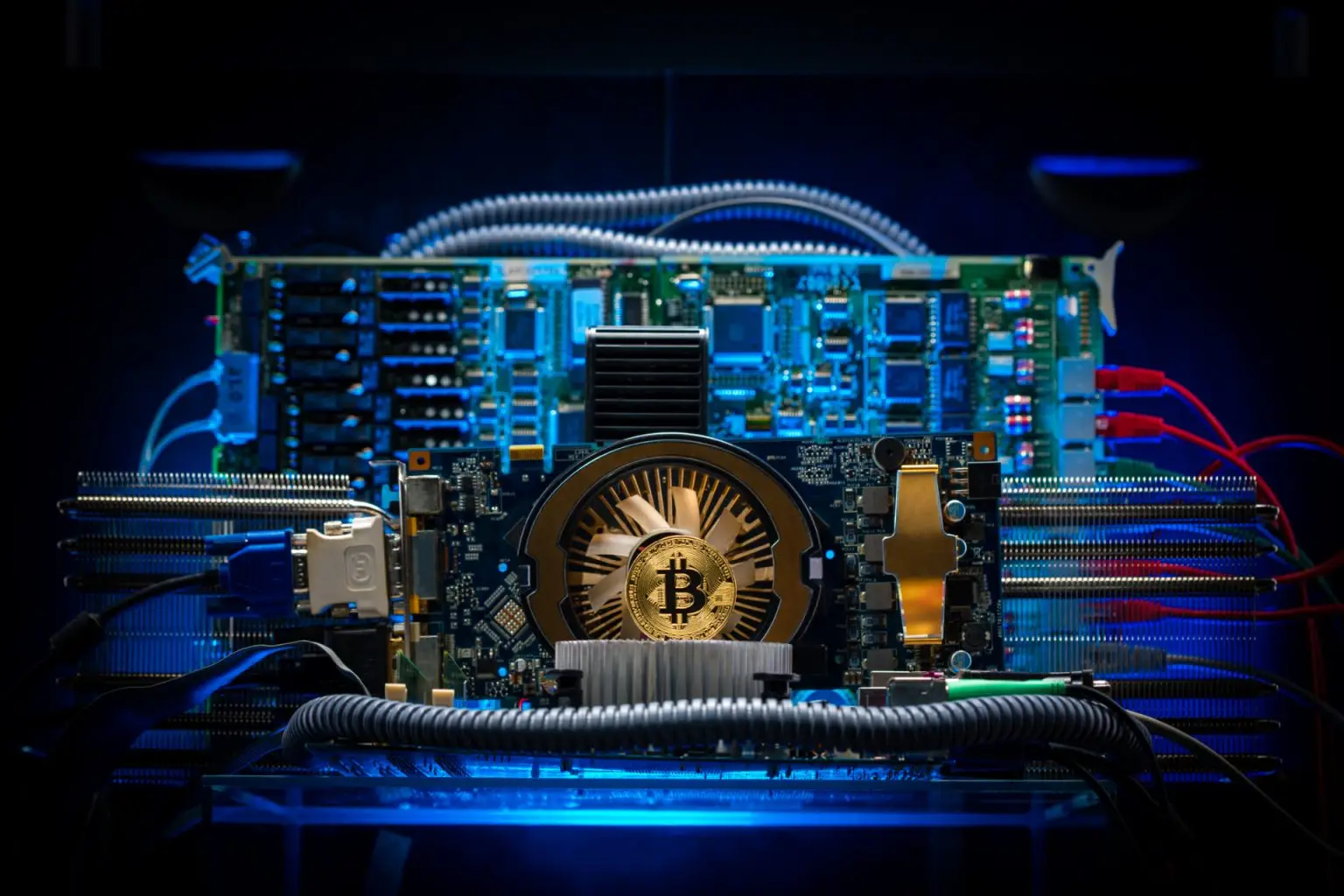

The digital economy is developing rapidly, and blockchain has become its cornerstone. However, the chain would not function without an important process: mining. It is, therefore, important to know what blockchain is and why it is needed. The system acts as the primary mechanism for creating new blocks and confirming transactions. Without blockchain, the security, decentralisation, and reliability of data cannot be guaranteed.

Mining allows network participants to verify transactions and add them to the chain, thus ensuring its integrity and stability. Miners compete to add a new block to the chain by performing complex calculations and finding the correct hash. The network checks the result once the task is solved and rewards the user. In this way, mining not only keeps the blockchain running, but also ensures the distribution of new bitcoins or other cryptocurrencies among network participants.

Without this mechanism, it would be impossible to speak of a secure and independent digital ecosystem. Therefore, it is important to understand why mining is needed and how it works in practice.

What is mining for?The main tasks of the process

The answer lies in the ability to maintain a stable and secure network in which every transaction is confirmed and recorded in an immutable ledger.

Ensuring blockchain security

Mining protects the blockchain from attackers by preventing the data in the blocks from being changed. The system is based on the proof-of-work principle, where miners solve complex mathematical problems. The found solution confirms that the work has been done honestly and that the block is valid. If you change one sector, all subsequent sectors must be recalculated. This makes attacks virtually impossible.

Transaction confirmation

Every transaction must be verified before it ends up on the blockchain. Miners collect transactions into blocks, verify their authenticity and add them to the chain. Without this mechanism, the network cannot guarantee that the money will not be spent twice. In this way, mining keeps the system honest and prevents fraud.

Creating new blocks

New blocks form the basis of the blockchain. Miners compete to add a block by performing calculations to find the correct hash. As a sector is added, the network grows and becomes more resistant to attacks. For each successful entry, the miner receives a reward in the form of new bitcoins or other cryptocurrencies.

Why do we need mining? The answer is obvious: it is the process that keeps the blockchain running, protects it from attacks, and ensures its growth.

How mining works: step by step

The process consists of several stages, and in each stage, users perform important tasks to maintain the blockchain. This can be understood by studying each step in the operation of this system in detail.

The process consists of several stages, and in each stage, users perform important tasks to maintain the blockchain. This can be understood by studying each step in the operation of this system in detail.

Composition of transactions

Miners collect transactions submitted by users. Each message contains information about the amount to be transferred, the sender’s address, and the recipient’s address. For example, when transferring bitcoins, data about the transaction amount and the time of the transaction are recorded and sent to the network.

Creating a block

The collected transactions are grouped into a block. The miner adds metadata, such as the previous hash and timestamp. A sector must meet the network’s requirements to be included in the blockchain.

Hash lookup

In this stage, the most labor-intensive part of mining begins. Miners search for the correct hash with enormous computing power. This process requires you to try out many combinations. Only the first to find a matching value gets the right to add a block to the chain and receive a reward.

Adding a block to the blockchain

When the correct hash is found, the block is sent for verification. The remaining network participants confirm the correctness of the data and the piece is added to the blockchain. This process ensures that all data in the chain remains intact and secure.

Why mining is necessary in simple terms: an accessible explanation

To understand why mining is necessary, we can think of the blockchain as a large ledger and miners as accountants. Every time someone wants to make a transfer, the user records the transaction in the ledger. Only after careful checking does the entry become official and remain in history forever.

A simple analogy

Mining is similar to minting coins. Imagine that each bitcoin is a virtual currency that needs to be created and verified. Miners perform this task using powerful computers to solve mathematical problems. The solution found ensures that the money is authentic and cannot be counterfeited.

Mining features

There are three:

- Transaction verification: Miners verify all transfers to prevent fraud.

- Network security: Blockchain is protected from attacks thanks to complex calculations.

- Creation of new coins: Users spend new bitcoins and receive a reward for this.

Why do we need mining? To ensure the integrity and security of the blockchain, so that every network participant can trust the data and transactions.

Is mining profitable? Pros and cons

To better understand why mining is necessary, it is worth looking at its pros and cons from an economic perspective.

Pros:

- Receiving a reward: A successful miner receives a reward in the form of new bitcoins.

- Network maintenance: Users play a key role in maintaining the blockchain.

- Long-term investment: As cryptocurrency exchange rates rise, investments in equipment can pay off many times over.

Disadvantages:

- High energy costs: Mining is energy-intensive and power-intensive.

- Hardware wear and tear: Computers and ASIC miners age quickly and need to be replaced.

- Process complexity: As the number of miners increases, the complexity of the network increases, which reduces profitability.

Conclusion

Why do we need blockchain mining? It is the mechanism that keeps the network running, ensures security and creates new currencies. It enables decentralized transaction verification and data protection against hacking. Without blockchain, the transparency and reliability of data cannot be guaranteed.

Why do we need blockchain mining? It is the mechanism that keeps the network running, ensures security and creates new currencies. It enables decentralized transaction verification and data protection against hacking. Without blockchain, the transparency and reliability of data cannot be guaranteed.

Miners fulfill the role of protectors and creators of the blockchain and ensure its stable development. Despite the high costs and complexity of the process, mining remains an important part of the digital economy.

en

en  de

de  ar

ar  es

es  nl

nl  hi

hi  fr

fr  it

it  pt

pt  el

el