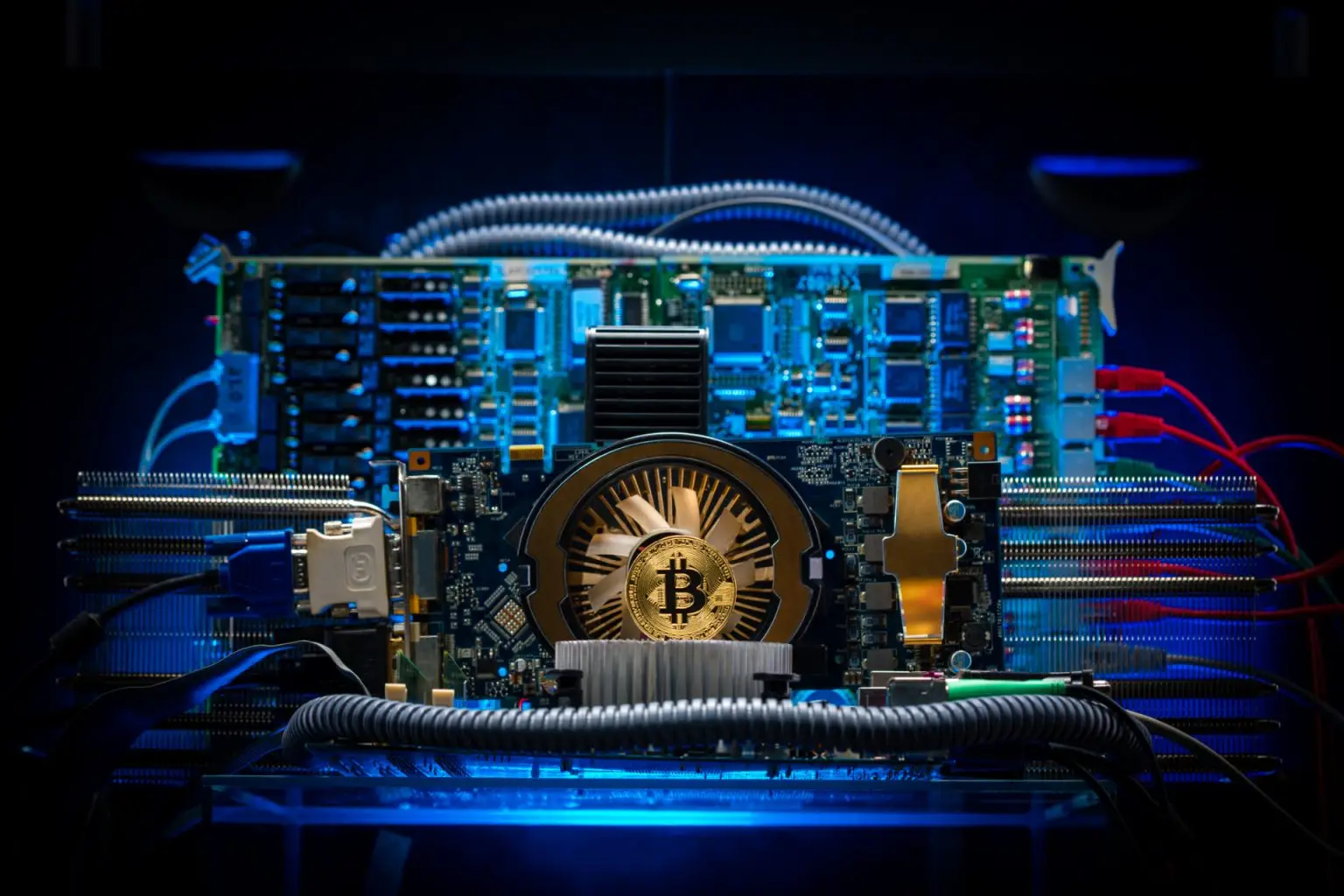

Crypto assets continue to intertwine with the economy, law, and technologies, and choosing the right cryptocurrency wallet in 2025 is one of the main questions for participants in the crypto sphere. The platform that provides storage, protection, and access to assets determines security, income, and risk level.

Types of cryptocurrency wallets: starting with classification

The crypto sphere uses various devices and technologies for storing digital assets. Choosing the right digital storage for cryptocurrency is a question that requires a precise understanding of the types of solutions.

Hardware wallets: ironclad protection

Offline devices provide a high level of security. Models like Ledger Nano X, Trezor Model T, SafePal S1 use multi-layer encryption and local storage of private keys. With no constant connection to servers, the risk of hacker attacks is reduced. This option is optimal for long-term asset preservation and minimizes risk.

Software wallets: mobility at hand

Mobile and desktop applications, including Exodus, Trust Wallet, Atomic Wallet, provide quick access to assets. For secure and convenient daily transactions, choose a wallet with mandatory two-factor authentication and the ability to store different assets. Software solutions offer speed but require special control over passwords and devices.

Custodial wallets: trust and speed

Exchanges like Binance, Bybit, Kraken offer built-in wallets with high liquidity. Here, cryptocurrency storage occurs on external servers, increasing the risk in case of exchange hacks. This option remains convenient for short-term trades or storing small amounts.

Cryptocurrency wallet security

In 2024, the market recorded over $1.5 billion in losses due to leaks of private keys and passwords. In 2025, choosing the right digital storage for cryptocurrencies becomes a task where cryptocurrency security takes precedence.

Encryption and code management

Modern digital storage solutions use algorithms like AES-256, BIP-39, and BIP-44 for generating seed phrases and keys. Protecting codes and passwords requires creating unique combinations, storing them in offline environments, and avoiding entering them on external devices.

Regulation and security technologies

Legislation has strengthened requirements for wallet providers. The EU has introduced MiCA directives, and the USA has approved new user identification rules. Choosing a crypto wallet should consider compliance with international standards and the presence of functions that meet regulatory norms.

How to choose a cryptocurrency wallet: detailed guide

In 2025, a smart choice of crypto storage requires a comprehensive approach, considering not only security but also the convenience of everyday use. Users should determine in advance which functions they need: fast exchange operations, high anonymity, or support for rare tokens. Different types of storage offer unique advantages and limitations, so it’s important to align them with personal financial goals.

When choosing the right solution, it’s important to consider the following parameters:

- Storage method: hardware or software wallet, depending on the volume and frequency of transactions.

- Security technologies: two-factor authentication, encryption, seed phrase protection.

- Supported devices: smartphones, PCs, separate hardware modules.

- Integration with exchanges and platforms: speed, fees, exchange rate, convenience.

- Regulation and legislation: compliance with jurisdiction requirements.

- Privacy level: access management, absence of mandatory data transmission.

- Support for digital assets: number of supported cryptocurrencies.

- Reviews and reputation: absence of critical hacks and leaks.

Additionally, it’s important to consider resilience to volatility through the ability to quickly interact with exchanges and platforms. A smart selection minimizes risks and protects assets.

Risk level and profitability: balancing on the edge of volatility

Choosing a crypto wallet affects potential income and associated risks. Exchange storages provide instant access but are susceptible to attacks. Hardware devices minimize risks but limit access speed. Software solutions balance between convenience and the need for increased privacy awareness.

Analyzing exchange rate volatility helps determine the volumes to be stored in different digital storages. Long-term cryptocurrency storage requires stable protection, while short-term operations allow the use of mobile apps and extensions.

The right choice of digital storage is a task where risk assessment, transaction speed, and potential profitability shape the optimal strategy.

How to choose a cryptocurrency wallet: current technologies and trends in 2025

Technological progress has introduced multi-signatures, biometric authentication, integration with decentralized exchanges, and P2P services. Cryptocurrency storage is accompanied by the use of hardware keys, voice passwords, and QR code scanning to confirm transactions.

Updated versions of Ledger and Trezor in 2025 support extensions for DeFi applications, while Trust Wallet has integrated direct exchange operations through its own gateways. In 2025, choosing a crypto wallet is determined not only by the level of protection but also by the accessibility of connection to modern financial platforms.

How to choose a cryptocurrency wallet: conclusions

Determining how to choose a cryptocurrency wallet in 2025 requires a strategic approach with an assessment of technologies, risks, profitability, and protection level. A smart choice reduces vulnerability, protects privacy, ensures fast transactions, and helps efficiently manage digital assets in conditions of high volatility.

en

en  ru

ru  de

de  ar

ar  es

es  nl

nl  hi

hi  fr

fr  it

it  pt

pt  el

el