2023 showed that the cryptocurrency market did not collapse. Bitcoin survived its peak, rebounded, and is again approaching key levels. Against this backdrop, platforms offering earnings through cloud mining have become more active – a model in which the equipment remains behind the scenes, and the user rents computing power. Everything is transparent, in the spirit of “pay and mine tokens.” But behind the simplicity lies a whole system with contracts, algorithms, and risks. Understanding how cloud mining works means understanding the logic of modern crypto-economics.

What is Cloud Mining

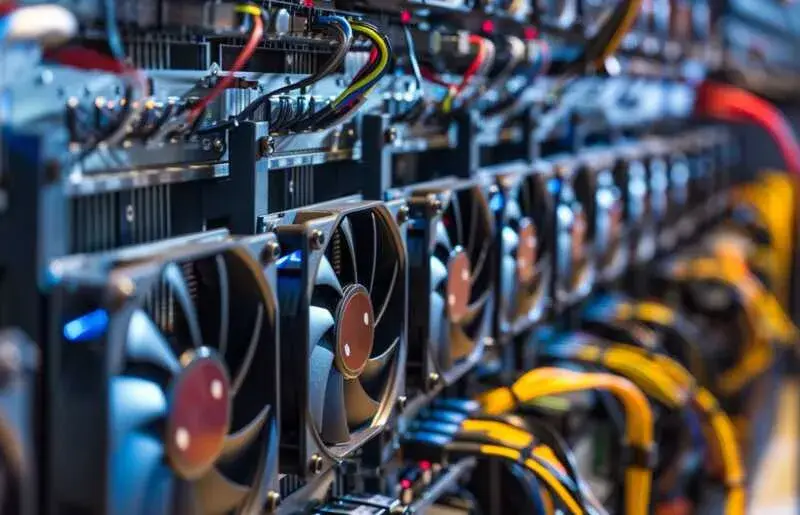

The idea was born as a reaction to the complexity of traditional mining. With the increase in the hash rate and network difficulty of Bitcoin, home farms gave way to data centers. The B2C model emerged as a way to monetize excess capacity through rentals. The client gains access to a server rack in Iceland or Canada, selects a contract, pays, and tracks income. Visually – like a bank deposit: investment, waiting, returns.

How Cloud Mining Works

The platform rents hash rate on its own equipment, distributes calculations to a pool, collects rewards, deducts a fee, and transfers the remainder to the user. An example is Genesis Mining, operating since 2014. The company manages farms in Gelleraut in Reykjavik, serves over 2 million clients, and ensures contract stability due to low electricity costs.

How to Calculate Results

The most important parameter is power, measured in TH/s (terahashes per second). The higher the power, the more blocks the system processes, and the higher the potential profit. At the same time, the platform deducts daily expenses for electricity and maintenance.

Example:

A contract for 100 TH/s at a price of $0.012 per TH/s/day = $1.2/day. With the current reward in the Bitcoin network – around 6.25 BTC per block, and considering a 2% pool fee, the income can range from $1.5 to $2.1 per day – depending on the BTC rate and network difficulty.

The actual profitability of cloud mining is determined by several factors: the Bitcoin rate, the platform fee, the number of active miners, and changes in the hash rate. Too many variables make stability impossible. Forecasting means relying on probabilities.

Can a Beginner Earn from Cloud Mining

A beginner will earn if they choose a reliable service, assess risks correctly, and do not invest everything in one contract. Without basic knowledge of blockchain and Proof-of-Work principles, there will be no earnings. Companies do not guarantee fixed income and often understate expenses in marketing promises.

How cloud mining works in reality – as a business with unpredictable demand. There are no guarantees, only potential profitability. Investment does not exempt from analysis. Especially if the platform does not disclose jurisdiction or commission calculation methods.

Risks of Cloud Mining

Every investment model involves risk. Here, there is a whole range:

- sharp decrease in BTC rate;

- network difficulty increase;

- equipment shutdown;

- hidden fees;

- legal legitimacy of operations in a specific country;

- cases of blatant fraud (Ponzi schemes disguised as services).

The HashOcean platform disappeared in 2016, leaving tens of thousands of investors without payouts. Conclusion: earnings are possible only when working with verified providers, public reports, clear business models, and real equipment.

Services, Prices, and Parameters: Guidelines for 2025

The current market offers dozens of solutions. Price ranges from $0.008 to $0.02 per TH/s per day. The level of service and legitimacy does not always correspond to the price.

Examples of platforms:

- Genesis Mining – a veteran in the market. Price starting from $0.012/TH/s, transparent reports, offices in Iceland.

- NiceHash – a flexible auction, where the user chooses the volume and rental price. High volatility.

- IQMining – contracts for various algorithms, income depends on their profitability.

Analyzing competitors helps choose an alternative to cloud mining or diversify the portfolio.

Alternatives to Cloud Mining

Mining involves various strategies. The choice of approach depends on budget, technical base, and earning goals. Each model competes and helps to better understand how cloud mining works.

Classic ASIC Mining

The Antminer S19 Pro delivers 110 TH/s with 3250 W consumption. Starting price from $2500. With a tariff of $0.10/kWh, monthly expenses exceed $230. The equipment requires cooling, maintenance, and access to stable power supply.

How virtual mining works: renting covers the technical side but reduces flexibility. ASIC allows scaling profits, but with increasing difficulty, the risk also increases.

GPU Mining

RTX 3080 and RX 6800 are used for Ethereum Classic, Ravencoin, and Flux. Entry threshold from $1500. Card income – $2-3 per day. Drawbacks: high wear and tear, driver dependency.

Unlike models where cloud mining profitability is clear, here – manual management, setup, and constant monitoring. Suitable for flexible strategies with multiple assets.

Staking

Proof-of-Stake allows earning without equipment. Ethereum requires 32 ETH. Services like Lido accept smaller amounts. Average yield – 4-5% annually. Risks: asset lockup, price drop, smart contract failures.

What is cloud mining – predictable rental. Staking is suitable for long-term investments without involvement in technical processes.

DePIN

Helium and Render Network provide an alternative to cloud mining. Hotspot devices cost $400-600. Rewards depend on geography and activity. RNDR tokens are earned for rendering capacities.

How cloud mining works – without physical participation. DePIN combines digital and real actions but requires profitability calculation and load analysis.

Farming and Lending

DeFi tools offer returns from 5% to 20%. Protocols like Aave and PancakeSwap use smart contracts. Potential risks include vulnerabilities, token volatility, and manipulations. Earnings from cloud mining are more stable but with lower returns. DeFi requires preparation, market assessment, and quick response.

Each alternative requires knowledge, management, and control. Can a beginner earn from virtual mining – depends on the choice between service comfort and independent infrastructure work.

How Cloud Mining Works: Conclusions

How cloud mining works – like renting a machine in a service: the platform handles the technical part, the client pays, tracks the result. Service-oriented thinking, not hardcore. Suitable for those who prefer practical forecasts.

High profitability requires a stable platform, understanding internal mechanisms, readiness for risks. Not every investor will make instant earnings, but with a skillful strategy, there will be a chance for diversified crypto income.

The profitability of mining depends on many factors: the price of electricity, the performance of the equipment, the complexity of the network and current market rates. To fully understand what crypto-currency mining is and how to assess its profitability, you need to consider all the costs – the cost of electricity and equipment depreciation.

The profitability of mining depends on many factors: the price of electricity, the performance of the equipment, the complexity of the network and current market rates. To fully understand what crypto-currency mining is and how to assess its profitability, you need to consider all the costs – the cost of electricity and equipment depreciation. What is crypto-currency mining? It’s a complex but fascinating process that not only makes the blockchain system work, but also generates potential income. The choice between the different ways of obtaining crypto-currency depends on the resources available and the willingness to take risks. It is an activity that requires significant knowledge and effort, but for many it is becoming not only a source of income, but also a way of participating in the new financial era.

What is crypto-currency mining? It’s a complex but fascinating process that not only makes the blockchain system work, but also generates potential income. The choice between the different ways of obtaining crypto-currency depends on the resources available and the willingness to take risks. It is an activity that requires significant knowledge and effort, but for many it is becoming not only a source of income, but also a way of participating in the new financial era.